Payroll Card for Employees that Everyone can Love

1 Central Bank of Kansas City does not administer, nor is liable for earned wage access.

Lead with the Payroll Card Employees want

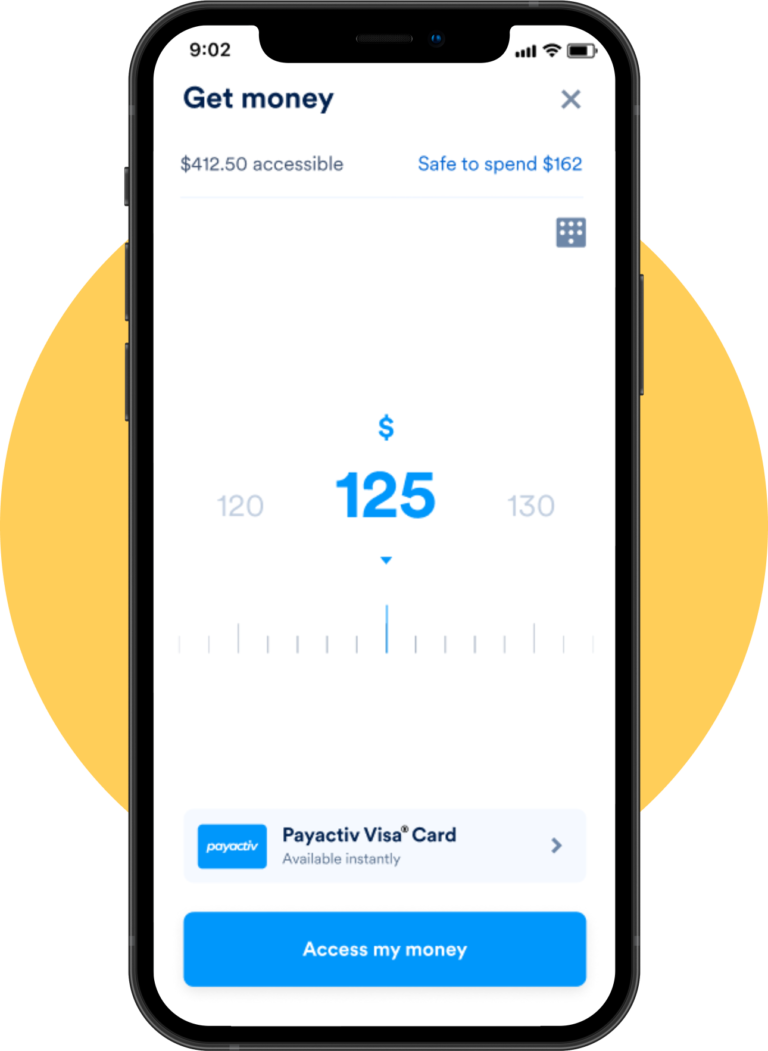

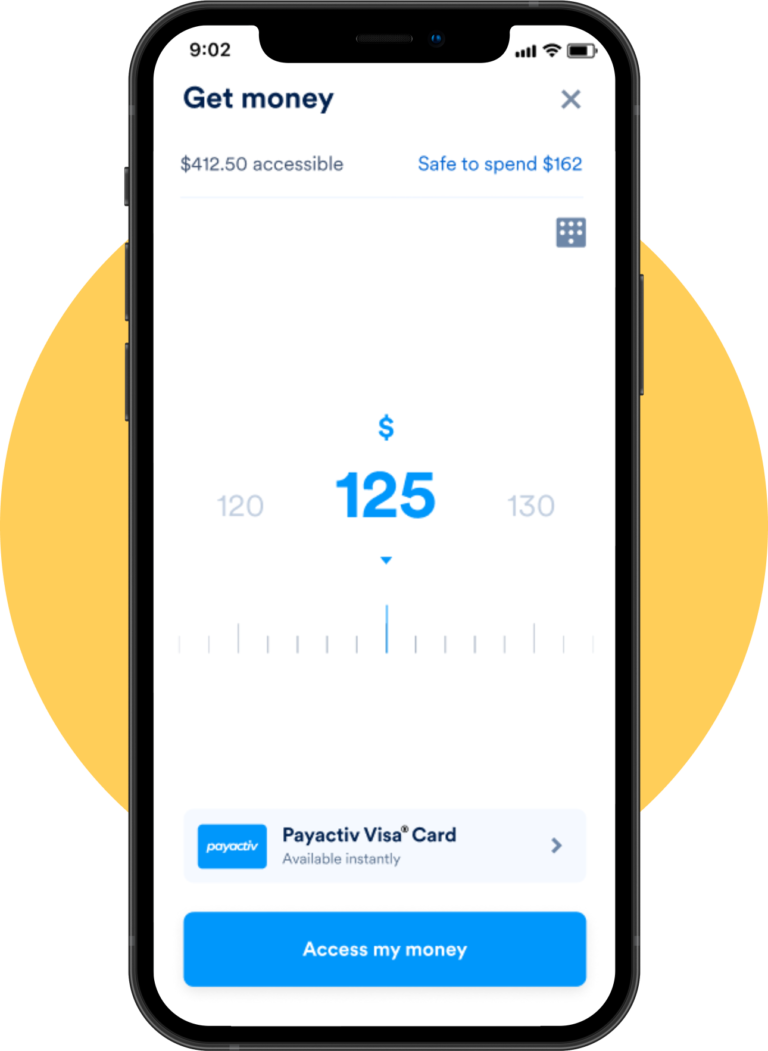

Employees get direct deposit up to 2 days sooner and have access to their earned wages on-demand.

Include more employees in digital banking. No minimum balance. No monthly or annual fees.

The Payactiv App provides access to mobile banking with smart budgeting tools, alerts, and integrated bill pay.

Access to financial learning and counseling, discounts, and award-winning goal-based savings.

Fast access to pay

Employees get direct deposit up to 2 days early2 and have access to their earned wages on-demand.

No hidden fees

Include more employees in digital banking3. No activation fees. No monthly or annual fees.

SmartSpend and SmartSave

The Payactiv App provides access to mobile banking3 with smart budgeting tools, alerts, and integrated bill pay.

Financial wellness

services

Access to financial learning and counseling, discounts, and goal-based savings4.

2 In order for you to be paid early, your payroll or benefits payment provider must submit the deposit early. Your payment provider may not submit the deposit early each payment period. Be sure to ask when they submit your deposit information to the bank for processing. Early deposit of funds begins upon the 2nd qualifying deposit. A qualifying deposit is defined as a direct deposit greater than $5.00 received from the same payer.

3 Payactiv is not a bank. Banking services are provided by Central Bank of Kansas City, Member FDIC.

4 Goal-based saving is a set-aside account, and you will not receive interest or other earnings on the funds within the goal-based account.

Go paperless, save time and money

Today’s workforce prefers to work for employers that support their financial wellness. Our EWA is free with direct deposit to Payactiv cards.

Digital payments of wages help keep your business and your workforce safer and give you the ability to pay them remotely even during disasters.

Save time and money on processing paper paychecks. Check out our Savings Calculator to see how much you could save by switching to paycards!

Electronically disburse bonuses, expense reimbursements and termination pay to employees’ paycards. Payactiv provides a 2-day cash float.

Increase payroll

efficiency

Save time and money on processing paper paychecks. Check out our Savings Calculator to see how much you could save by switching to payroll cards!

Easily issue off-cycle payments

Electronically disburse bonuses, expense reimbursements and termination pay to employees. Payactiv provides a 2-day cash float.

Stand out with

On-Demand pay

Today’s workforce prefers to work for employers that support their financial wellness. Our EWA is fee-free with direct deposit of at least $200 per pay period.

Improve payroll

security

Digital payments of wages can help your business securely process wages and give you the ability to pay employees remotely, even during disasters.

Savings for your business

Note: Estimated annual savings is based on industry averages for paper paychecks. Actual results may vary.

Dedicated team for successful rollout

We work with you to ensure a successful plan and launch of our program.

We prepare and provide customized materials to promote the program to your employees.

We are payroll compliant in all 50 states and use industry best practices.

We offer tools and training to get the most value out of the program, and a dedicated Account Manager.

We provide 24/7/365 customer support in English and Spanish to help answer questions along the way so you don’t have to.

Our data is encrypted, SOC2 compliant, ISO 27001 controls in place. We don’t store sensitive employee data.

Easy implementation

We work with you to ensure a successful plan and launch of our program.

Marketing material

We prepare and provide customized materials to promote the program to your employees.

Compliant

We are payroll compliant in all 50 states and use industry best practices.

Account manager

We offer tools and training to get the most value out of the program, and a dedicated Account Manager.

Customer support

We provide 24/7/365 customer support in English and Spanish by toll-free phone and online live chat.

Safe & Secure

Our data is encrypted, SOC2 compliant, ISO 27001 controls in place. We don’t store sensitive employee data.

How it works

1. Order Employee cards

Get instant issue cards to hand to employees when they start or let us help you with enrollment, including batch processing.

2. Start payouts

Start employee payroll, tips, off-cycle payments to their account. Signup new employees and monitor activity.

3. Employee access

Employees activate their cards and use the Payactiv App to manage their account and access financial tools.

Switching from another employee payroll card provider?

© 2025 Payactiv, Inc. All Rights Reserved

*The Payactiv Visa Payroll Card is issued by Central Bank of Kansas City, Member FDIC, pursuant to a license from/by Visa U.S.A., Inc. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. Consult your Cardholder Agreement and the fee schedule. If you have any questions regarding the Card or such fees, terms, and conditions, you can contact us toll free 24/7/365 at 1 (877) 747-5862.

1 Many (but not all) employers, government benefits providers, and other originators send direct deposits early with an effective date of 1-4 days later. Beginning with your second direct deposit of at least $5 from the same source, Central Bank of Kansas City (CBKC) will post the funds to your Payactiv Visa Prepaid Card when we receive it, rather than on the effective date. This may result in your having access to the funds sooner. The date CBKC receives your direct deposit and the effective date are controlled by the originator.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW CARD ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens a Card Account. What this means for you: When you open a Card Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identifying documents.