Everything You Need To Know About 50/30/20 Budgeting

Not all of us are great with money, and it shows in the numbers. In fact, The Federal Reserve reports that nearly 40% of Americans don’t have enough cash on hand to cover a $400 expense.

Well, there are certain financial habits that can help people prepare for these situations, and some of them are better than others. Let’s talk about 50/30/20 budgeting and how it can help your financial power.

The Value of Saving

The most compelling reasons for budgeting properly and prioritizing saving are greater peace of mind and less stress. When money is tight, it can lead to sleepless nights and feelings of anxiety that can manifest in unwelcome physical symptoms such as headaches, stomach disorders, and even high blood pressure. Moreover, financial worry can cause people to become irritable and withdrawn, which can negatively impact their relationships with family, friends, and coworkers.

Over the longer term, having a solid savings fund will also give you the comfort and satisfaction of knowing you’ll be able to pay for your kids’ college tuition and have enough money to retire.

What is 50/30/20 Budgeting?

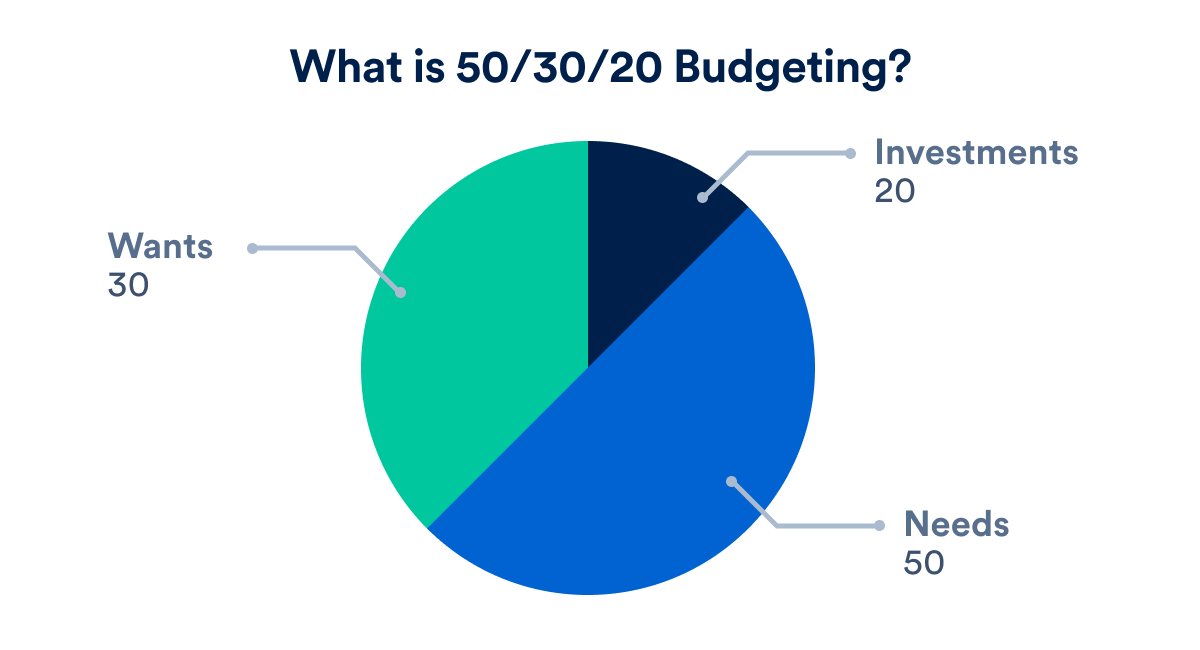

This budgeting tool has been around for a while, and many economists and financial experts agree that it is the best way to utilize your monthly income. The 50/30/20 represents the percentage of your take-home cash and where it will be going.

What is the Origin of the 50/30/20 Rule?

The 50/30/20 rule was popularized in the 2005 book “All Your Worth: The Ultimate Lifetime Money Plan,” which was penned by US Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi.

The pair drew on over two decades of research to propose that budgeting needn’t be a complex and arduous endeavor. Instead, they argue that all we need to do is balance our monthly income across our needs, wants, and savings ambitions by applying the 50/30/20 rule.

Breaking it Down

The “50” represents the things you need, the “30” represents the things you want, and the “20” should be allocated for investment activities.

Now, this is the ideal spending scenario for your cash, but it’s important to keep in mind that budgeting is never a perfect science. Unknown expenses come up, things get missed in our calculations, and other problems arise. However, this is what you should be striving to achieve with your budget.

Everybody’s income and expenses are different, but almost all budgets can be made to work with this structure. Let’s talk about each category so that you know how to fit your budget around this model.

What Falls in the “50” Category?

Things you need will include all of your essential expenses like bills and groceries. These are the ones that you shouldn’t feel bad about at all, as long as you aren’t living beyond your means.

If you can’t fit these expenses into 50% of your budget, consider downsizing or working to increase your after-tax income. These bills tend to stay relatively consistent, and different needs can come up at any time.

For example, if you rely on your car to get to work and your car breaks down, that’s an unexpected expense that fits into this category. However, if you’re always hugging right at 50% for your necessary expenses, then you may not be able to cover this expense.

If you keep your needs closer to 40% and save up a little for these emergency necessities, that’s even better. Then, you’ll never have to dip into your fun money or your investments.

Okay, back to cutting down on expenses. If your rent exceeds 25% of your after-tax monthly expenses, consider if downsizing is an option. If you can save money by switching to a different utility company, try it out. However, it’s difficult to save too much on these, but there are creative ways to reduce monthly expenses.

One of our biggest expenses is food. Don’t feel bad about a big grocery bill. If you spend $120 in a week and you eat all of the food, then you have nothing to feel bad about. If the alternative is getting $10 fast food meals twice a day and only paying $60 for groceries, you saved yourself $80 in that week.

Grocery shopping is a place to save money, not waste it. Use coupons or rewards programs to save even more money, and don’t buy anything that you don’t think you’ll use. Remember, never shop hungry!

If you have credit card debt, consider this a temporary necessary expense and work to pay it off. Dipping into your wants or even investments for this is acceptable in the short term, especially for high-interest loans.

What are the “30”s?

There’s no way to not spend money on things that you want, and any budget that tells you that you can’t isn’t even worth trying. If you work 40+ hours a week, you deserve to indulge in certain things. The only point of budgeting is to put a limit on how much you’re spending, and the easiest thing to cut is the things we want.

It’s very important to differentiate between things that you want and things that you need, and this line can be blurred when it comes to certain recurring bills. Let’s use the word “bills” for critical expenses like utilities, rent, and even WiFi, and we’ll use the term “subscription” for everything else.

If you have Netflix, Hulu, Disney+, Peacock, HBOMax, and cable, you can definitely get rid of at least one. Even if you watch a movie on one of them every single month, you would save money by renting one on YouTube or Amazon for $2.99 or $3.99. That’s an easy way to cut down.

The average American spends $47 on subscriptions every month. These may be magazines, Patreon creators, news outlets, and more that you subscribe to every month. While drawing up your budget, consider if these truly belong in your “wants” category. They absolutely might, so keep them if you enjoy them! However, consider them, nonetheless.

Other than your subscriptions, it’s pretty easy to tell what you want. You don’t have to go out to eat, buy the newest headphones, or order that thing from Amazon. Now, that isn’t to say that unexpected expenses that are necessities don’t come up, as they absolutely do.

However, before every purchase, consider which category it will fall into. If you know that you’re allocating less of your budget to things you want, then it will help you make smarter financial decisions.

What are the “20”s?

Okay, now it’s time for investments! Try to allocate 20% of your after-tax income toward investments and savings, but don’t leave all your eggs in one basket.

Retirement accounts, stocks, bonds, REITs, savings accounts, and more. These are all great places to put your money if you know what you’re doing. There are also plenty of alternative investments you can make, like saving up to buy a rental property or start a business.

Purchasing a rental property or investing in a REIT is a great way to yield some passive income for your retirement. The best thing to do would be to reinvest your dividends as time passes. You’ll be surprised how much you can earn in 20 or 30 years.

These don’t have to be the only real estate purchases that you can consider as an investment. If you’re a renter, you’re throwing money down a drain. Saving up to buy a house and start accumulating wealth as you pay off your mortgage can be considered an investment.

Putting money into a retirement fund is always a wise investment, even if (especially if) you’re really young. If you’re between 18 and 29, you have so much time to save for retirement, and you can almost guarantee yourself a secure retirement if you start a savings plan now.

Stocks are one of the most common options for investments, and for good reason. Let’s say you make $50,000 a year after taxes, and you put 20% of that into various stocks. The average annual return on the stock market is 6%, and you will earn compound returns as time goes by.

This means that with the initial $10,000 investment after one year, you would see an average of a $600 return, and now there’s $10,600 to earn 6% on, and that only adds up as years go by, especially if you’re putting more and more money in.

Whatever your investment choices are, stick with what you know. If you know nothing about investing, take the time to read up on it and begin making wise financial decisions.

Tips on Designing Your Budget

Your budget is unique to you, but if you do your best to stay as close to 50/30/20 as possible, you’ll be glad you did later on. 20% of your after-tax income compounded over the course of a few years or decades is almost guaranteed to offer you a large sum.

Break Down the Times

You will need to choose a period of time that works for your budget so that you can measure your 50/30/20 scheme as time goes by. This is totally based on how you will feel the most comfortable.

Do you feel more comfortable creating a monthly budget, weekly budget, or a budget between pay periods? Monthly budgets are the most common, but they can seem overwhelming to some, especially if you spend too much early in the month on non-necessities.

Weekly budgets can be a little hectic since they go by so quickly, and your bills are set by the month. If you get a paycheck every couple of weeks, you can also try it that way, assuming you know your billing schedule and plan ahead for that.

If your employer offers earned wage access, this is a great tool when it comes to planning ahead and creating your budget ahead of time.

Be Consistent

The biggest factor by far is consistency. If you can get past the initial 2 or 3 months and develop a rhythm for your spending habits, it will become a lot easier.

If you make a mistake one month, don’t consider it a failure or that the budget game is over. You still have a lifetime of months ahead, so just try to be as consistent as possible as months go by. Remember, this is a marathon, not a sprint.

Don’t Be Too Strict

That’s not to suggest that you shouldn’t try to fit this model as closely as possible as you should. However, don’t overwhelm yourself to the point where you’ll give up.

Budgeting is like trying a new diet. If you’re being overly restrictive to the point where you find no enjoyment in the activity, you won’t adhere to it. If you’ve run out of your fun money for the month because you bought new winter clothes to prepare for the season, and you’re dying for an $8 burrito, it’s not going to kill you.

Again, the number one factor is consistency. If you’re trying to fit this model as closely as possible every month, your investment account will be thankful in a few years from now, even if you found a couple of bumps in the road during a few particular months.

Automate

One of the benefits of direct deposit is that you can have 80% of your paycheck put into your checking and 20% into your savings account. You could also have a separate checking account for your bills and one for your fun money and have your paycheck distributed that way.

Have your bills set to auto-pay, allow 20% to go to your investment account, and more. This is a great way to budget with minimal day-to-day effort.

This could also include leaving your money with a financial manager or a retirement fund. That way, you won’t be responsible for buying and selling stocks, maintaining a rental property, or reinvesting your dividends. No matter what your investment choices are, you should allocate some of your funding into a retirement fund, especially if your employer offers a benefit matching. It will act as a safety net for your future.

Remember Why

It’s important to have a specific reason as to why you’re doing this. What is it that you’re saving for? What are your most important financial goals? Whether it’s retirement, sending a child to college, buying a home, or anything else, make sure you have a reason in mind for when things get difficult.

Motivation and consistency are the keys to a successful budget, so offer yourself reminders about your “why.” When the time comes, and those investments pay off, you’ll be glad you did.

Alternative Budgeting Techniques vs. the 50/30/20 Rule of Thumb

Some other prominent budgeting approaches that are viable alternatives to the 50/30/20 Rule and can assist you in reaching your financial goals include:

The Envelope Approach

This approach is suitable for people who like physically seeing their money and where it goes or simply just prefer to keep cash on hand.

With this model, you place cash into three or four separate envelopes every month and write down on each what that money is to be used for. Then, you only spend that amount of money on those things.

The 80/20 Budget

Like the 50/30/20 method, the 80/20 budget also uses percentages, but just two broad categories. This makes it a slightly less complicated approach. If you follow this model, you deposit 20% of your paycheck into a savings account and spend the remainder however you want.

The 70/20/10 Budget

More recently, it’s been suggested that ongoing inflation and wage stagnation is making the 50/30/20 approach to budgeting somewhat unaffordable for many people. It’s argued that the percentages of the 70/20/10 Rule are better suited to the average American’s current financial situation. With his model, 70% of your monthly income goes towards essential items and discretionary spending, 20% goes into savings, and 10% goes towards paying off debt.

Zero-Based Budgeting

With this rule, you assign a purpose to every single dollar of your monthly income. First, you allocate what’s required for your basic needs. Everything else is allocated to wants, savings, and debt repayments until the remainder is spent.

Don’t Give Up on Your Financial Goals!

The key to 50/30/20 budgeting is to be consistent. If something doesn’t work in your budget, try it a different way! Just figure out what works for you and try to make it into a lifelong habit. Either way, keep practicing healthy financial habits, stay up to date with our latest financial news, and contact us with any questions!

How Payactiv Helps

If you’re looking for help managing your expenses without the fear of late fees, the need to borrow from friends, or the need to take out predatory loans, speak to your employer about adding Payactiv’s services to their employee benefits package.

Through our Earned Wage Access service, Payactiv helps provide quick access to cash for people who have an emergency or who experience cash droughts by providing access to earned but unpaid wages. We don’t offer personal loans, and using the service won’t affect your credit score. Perhaps most importantly, we don’t leave you with bad debt.

You can access your earned wages in several ways. The funds can be loaded onto a debit or prepaid card, transferred to your bank account, or even picked up as cash at Walmart. Alternatively, Payactiv allows you to use your earned wages to pay for services like Uber and Amazon and pay your bills directly in the app.

Payactiv also comes with a revolutionary allocation and savings tool to help you reach your financial goals, plus free financial services to pay bills online, make bank transfers, and earn rewards.

If you’re an employee and think that our services would benefit you, then why not tell your employer about it?

Get Payactiv for your business

Related Articles

From your credit score to your bank account, reviewing your finances and moving...

From the comical influx of pumpkin spice products to the social pressure you...

On this episode of Good Cents, we’re tackling BIG money questions What is the...

© 2025 Payactiv, Inc. All Rights Reserved

24 hour support: 1 (877) 937-6966 | [email protected]

* The Payactiv Visa Prepaid Card and the Payactiv Visa Payroll Card are issued by Central Bank of Kansas City, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and the Fee Schedule at payactiv.com/card411. If you have questions regarding the Card or such fees, terms, and conditions, you can contact us toll-free at 1-877-747-5862, 24 hours a day, 7 days a week.

** Central Bank of Kansas City does not administer, nor is liable for earned wage access.

Payactiv, Inc.

NMLS ID: 2591928

Payactiv holds earned wage access services (EWA) license number 2591928EWA with the Wisconsin Department of Financial Institutions.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Google Play and the Google Play logo are trademarks of Google LLC.

Galaxy Store and the Galaxy Store logo are registered trademarks of Samsung Electronics Co., Ltd.